Ji Kyun Ji (GQG) Partners and The Rajeev Jain's clandestine Fund Management : The Long Story, Not the Indian Sock-puppet Media Version

Indians must have heard this company name, "GQG Partners" for the first time only in last week. Rajeev Jain on the other hand is something most Indian had heard of, almost everyone knows 2 to 20 different Rajeev Jain(s) in India.

This is not about them, but about Indian-born American citizen, who runs some GQG fund. His main clientele are Pension Funds , NRIs (Specially "Hindus for Trump" group) and Rich American Widows .

Pension funds & rich widows have to invest minimum of half a million and are called as "Institutional Investors" and this fund also accepts money from middle class Americans and NRIs, provided they give $2500 first. Basically they take money in smaller amounts also like India's own infamous Chit funds. The source of all these screenshots are from a draft report found SEC advisory archive, which had neither approved or disapproved this GQG fund.

His main company is Registered in US Tax haven state of Delaware and like most fly-by-the-night operators in US Financial Sector .. is a "Limited Liability Company". And He had opened branches in UK and Australia.

Source of these screenshot is the Opencorporate website. I will come to UK and Australia outfit's operations little later. Let start with US company, where it all began.

On the Topic of LLC , general guidelines of SEC is, Trustees are only liable if it can be proved that they acted in bad faith, gross negligence or malpractice.

Multiple US government and SEC advisories also state his company being from Kansas city, Missouri and Fort Lauderdale, Florida and New York. He made his money during "Zero to Negative fed rate" era. Even data from SEC advisory report shows that. "Trump Trade Rally" or the "Stock market bubble" of 2017 to 2019 helped every small "Fly-by-the-night" operators.

This GQG fund had one and only one, Portfolio Manager, Mr. Rajiv Jain .. who was also claimed to be the CEO of GQG partners (of Florida office) as well as Chairman of that firm.

For GQG Fund, Mr. Rajiv (Sometimes spelt Rajeev) Jain is also responsible for investment adviser as the Chairman (perhaps Tableman and floorman also) of GQG Partners

if you think, I'm doing copy-paste of same sentences .. SORRY.. That is what SEC advisories do.. they have a template (probably Microsoft word) and they just copy-paste same thing over and over again. For example, 99% SEC advisories cite same Risks for all funds of same grade. However in this screenshots, This report has claim Rajiv Jain, GQG partners, Florida has contractually obligated to waive the consulting/ adviser fee from GQG partners, Delaware for this GQG Fund for which they gave a Kansas City, Missouri mailing address. I'm sharing that mailing address down below:

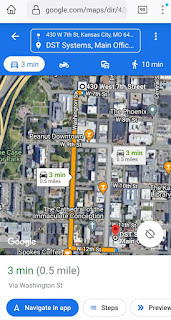

Google maps now says, Express mail address of Kansas City, Which belonged to DST systems.. well their main office in Kansas city is Permanently closed. God help the investors trying to redeem their investment in GQG funds by Express Mail.

GQG funds doesn't consider US mail or any other mailing service as its agent. So I don't think, they will walk 10 minutes from mailing address to DST systems, main office to check whatever is happening there.

SEC personnel who drafted this report, had no official prerequisite of knowledge of basic geography.. how far, Kansas City is from Fort Lauderdale, Florida and how far it is from Boston, Massachusetts; where this funds assets are kept under the custodian: Brown Brothers Hartman & Co.

I

If you complain like me, then GQG will send Lawyers from Philadelphia firm Morgan, Lewis and Bockius ..

Poor SEC chap even forgot to update "Independent Registered Public Accounting Firm" section for GQG funds .. It seems GQG Funds prospectus is source of SEC report.. whatever is present their like Fund Trustees biography or Portfolio Manager biography is word by word same.

On

Fund Trustees and their shares and compensation/salaries from the Fund, this topic report says:

Independent trustees all receive annual

compensation and because the share-holding is less than 1% .. so every

thing is "all right" .. All but one of Trust officers are from SEI

investments, Philadelphia.. but everything is "all right" because except

Chief Compliance Officer of SEI, no one received any money from GQG as

regular Compensation.

Yet no RED FLAG. Of course, this report doesn't give Green Flag also and I'm eternally grateful to SEC and the author of this report for sharing this.

MAY I GIVE A SUGGESTION TO SEC? PLEASE INCLUDE AN ORGANISATION GROUP CHART , where all registered entities (parent company, branches, subsidiaries and joint ventures) are listed and colour code each entity based on type of company (LLC, LLP in one colour, INC, Limited company in another colour, Private company in another).

And all independent Companies acting as an agent of the company can also be represented in that chart via an arrow linked line. Any cross-holding can be represented by another dashed line connecting two entities.

Declutter your documents, SEC .. not everyone is a lawyer who loves to read same thing over and over, so he can charge 1 extra hour to the client.

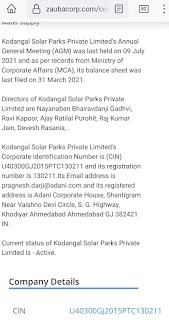

Let's Switch Continents: let's see why GQG is Private Limited company in UK and it's performance.

Apparently GQG partners in UK is barely one or two cubicle operation. Thankfully to people like us, UK discloses the annual financial results on internet and we find total revenue of GQG was only £600,000 ..

And they have only 3 employees there..

All the revenue came from GQG partners' US based funds.

So UK operation can't be the source of any single investment which is over 1 billion. So far the data from these reports show that given their claim of diversified portfolio and salary patterns of Senior People, even any single investment of 100 million will be their tallest order and champagne bottles will be cracked open ..

Among clients who already invested in US funds of GQG, only BNP Paribas can be considered "Big Bank" .. so where did this money came to "GQG fund" ..

Let's Take A Look in GQG Partners, Inc; Australia

Aha! They opened a branch in Sydney Australia as GQG Partners, Inc .. this looks promising, as GQG's US outfit is LLC and UK outfit is Private Limited they can't sell shares in stock market... but any "Inc" or "Corporation" or "Limited Company" can..

And surprise, surprise.. they are listed in Sydney Stock Exchange.. and GQG shares are losing its share value.. ever since they were listed at 2 Au $ and with Adani Investment news fell 3% more.

There are reports that 4 Pension funds who had invested in GQG, have asked; Why their money has been invested in Adani group after the Hindenburg research report?

It's there on Australian Reuters report, which by AI magic gets automatically redirected to Reuters India report in India..which says "Adani shares jumped 17% after GQG investment" and completely ignoring the fact that "GQG is a penny stock in Australia and still it fell 3%"..

Even "BBC World (meaning Singapore) Service" chose to report only Reuters India version..

As if, India would not feed US and UK foreign secretaries at G20 meet .. in case they report the truth from Australia?

Fact is, GQG will fold operation.. whenever they will face serious redemption pressure. The hints and clues are all over their documents and the Parent company being a "Limited Liability Company" .. top executives would not face any legal problems.

In fact, they must have swindled enough dough in Cayman or Virgin Islands, to have a rich, elite lifestyle till death.